25th INFER Annual Conference 2023/

XXth INTECO Workshop on Economic Integration

6-8 September 2023, Valencia – Spain

The INFER Annual Conference is the main annual event of the International Network for Economic Research. This year the INFER AC will take place jointly with the XXth INTECO Workshop on Economic Integration organized by INTECO research unit.

Conference Programme

- Download: Conference Programme (pdf)

| TIMETABLE: | |

| Day 1 | 6th September, 2023 | |

| 10:00 - 13:00 | INFER Board Meeting | Room 4P19, South Building |

| 14:00 - 16:00 | Registration | West Building |

| 16:00 - 18:00 | PARALLEL SESSIONS 1 | West Building |

| 18:00 - 18:20 | Coffee break | West Building |

| 18:30 - 18:45 | Welcome Address | Room 101, South Building |

| 18:45 - 19:45 | Keynote speaker 1: Gabriel Felbermayr | Room 101, South Building |

| 19:45 - 21:00 | Welcome Cocktail | Lobby, Faculty of Economics |

| Day 2 | 7th September, 2023 | |

| 08:00 - 09:00 | Registration | West Building |

| 08:30 - 10:00 | PARALLEL SESSIONS 2 | West Building |

| 10:00 - 10:20 | Coffee break | West Building |

| 10:30 - 11:30 | Keynote speaker 2: Giovanni Peri | Room 101, South Building |

| 12:00 - 13:30 | PARALLEL SESSIONS 3 | West Building |

| 13:45 - 15:00 | Lunch | Canteen, West Building |

| 15:30 - 17:00 | PARALLEL SESSIONS 4 | West Building |

| 17:00 - 17:20 | Coffee break | Canteen, West Building |

| 17:30 - 19:00 | Round Table: Polycrisis or Secular Stagnation? | Room 101, South Building |

| 19:00 - 20:15 | INFER General Meeting | Room 101, South Building |

| 21:30 | Gala Dinner | City of Arts and Sciences (Contrapunto Les Arts Restaurant) |

| Day 3 | 8th September, 2023 | |

| 09:00 - 10:00 | Registration | West Building |

| 10:00 - 12:00 | PARALLEL SESSIONS 5 | West Building |

| 12:00 - 12:20 | Coffee break | West Building |

| 12:30 - 13:30 | Keynote speaker 3: Isabelle Méjean | Room 101, South Building |

| 14:00 | Lunch | Canteen, West Building |

| PLENARY SESSIONS: | |

| Keynote Lecture 1: Economic sanctions – evidence from the Global Sanction Database Gabriel Felbermayr | WIFO (Austria) | Keynote Lecture 2: Immigration and Firm-Worker Matching Giovanni Peri | UC Davis |

| Keynote Lecture 3: Frictions and adjustments in firm-to-firm trade Isabelle Méjean | SciencesPo | Round Table: Polycrisis or Secular Stagnation? A. Morrón | CaixaBank Research E. Alberola | Bank of Spain E. Feás | Elcano Royal Institute |

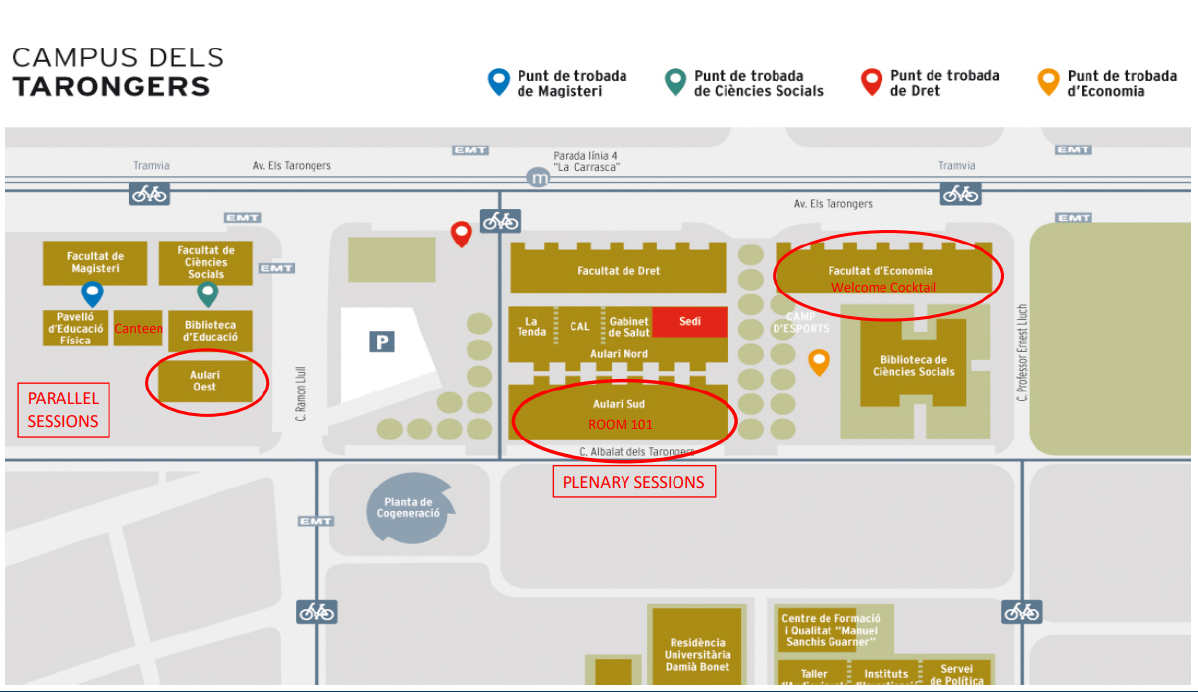

The venue will take place at the Campus dels Tarongers of the University of Valencia in the following sites (circled in red on the map):

1. Aulari Ouest (West Building)

2. Aulari Sud (South Building)

3. Faculty of Economics-Library

You can download the MAP here!

*Gala Dinner: City of Arts and Sciencies

Contrapunto Les Arts Restaurant (Restaurante Contrapunto)

Avinguda del Professor López Piñero, 1

46013 València

Valencia, España

For a general view of the campus and the city click on: video Valencia-Campus Tarongers

ARRIVAL IN VALENCIA

- The city also has two main railway stations, “the Estación del Norte” (local train network operates), and “Joaquín Sorolla station”, offering AVE high-speed.

- Valencia is equipped with a modern motorway network. Nothern AP7 (Barcelona direction), A3 (Madrid) and southern AP7 (to Alicante).

- The airport (Manises), located just 8 kilometers from the city center (connected by underground to the city center). There is a metro service straight from the airport to the city center: lines 3 (red) and 5 (green). The station is situated on the ground floor of the arrival’s hall in the Regional Terminal. Journey time to the city centre is approximately 25 minutes. Both lines follow the same route to Xativa and Colón stations, which are close to the city center.

- Valencia’s taxis are white and run by local companies. They all charge the same rates in the city center – airport runs (20€) and are available 24 hours a day.

- Hotels can also provide a personal transfer service straight to the airport.

ACCOMMODATION

Participants are responsible for their travel and accommodation arrangements. The registration fee does not cover accommodation.

You can make your own reservations to several hotels not very far from the conference venue. Consider that rooms in the suggested places are subject to availability:

- HOTEL BARCELÓ VALENCIA – Ciudad de las Artes, 25 min bus lift to UV or downtown

barcelo.com/en-gb/hotels/spain/valencia/barcelo-valencia/ valencia@barcelo.com – Phone: +34 96 330 63 44 - ILUNION AQUA 4 – Ciudad de las Artes, 30 min bus lift to UV or downtown

https://en.ilunionaqua4.com/ Phone: +34 963 18 71 00 - HOSTAL VENECIA – Plaza del Ayuntamiento – Downtown 25 min bus lift to UV

hotelvenecia.com/en/ – Phone: +34 963 52 42 67 - HOTEL OLYMPIA UNIVERSIDADES 3 * – Benimaclet, 15 min bus lift to UV or 10 min metro ride.

https://www.hotelolympiauniversidades.com/ – Phone: +34 963 69 21 29 - HOTEL SILKEN PUERTA VALENCIA 4* – Mestalla Stadium, 20 min bus lift to UV.

https://www.hoteles-silken.com/en/hotel-puerta-valencia/ – Phone: +34 963 93 63 95 - However, if you would like to look for other accommodation options, we recommend websites such as Booking, Expedia or Airbnb (if your preferred option is an apartment).

TOURISM INFORMATION ABOUT VALENCIA:

FURTHER INFORMATION

The conference website (https://infer-research.eu/events/25th-infer-annual-conference/) will provide updated information concerning registration details, downloadable registration forms, travel and accommodation facilities, etc.

Questions may be directed to the conference organizers.

Questions about local organization issues may be directed to the local conference organizer:

Cecilio TAMARIT – e-mail: cecilio.tamarit@uv.es

Questions about INFER procedures may be directed to the INFER Board through:

Josep-Maria ARAUZO-CAROD – e-mail: josepmaria.arauzo@urv.cat

Registration must be done on the INFER website. The deadline for registration is: June 15th, 2023

LIST OF ACCEPTED PAPERS:

(Avaible for download in PDF)

| ID | Paper title | Authlist |

|---|---|---|

| 1 | Financial globalization with firm heterogeneity | Eduardo L. Giménez; Universidade de Vigo Delfim Gomes Neto; Universidade do Vigo |

| 2 | Terrorism, Insurgency, and State Repression in MENA Countries | Christophe Muller; Aix-Marseille University Pierre Pecher; Aix-Marseille University |

| 3 | Spatial Convergence among Indian Districts: An Econometric Evidence | Manish Chauhan; IIT Kanpur |

| 5 | On Working from Home in European Countries and ICT | Vahagn Jerbashian; University of Barcelona Montserrat Vilalta-Bufi; Universitat de Barcelona |

| 6 | On the Elasticity of Substitution between Labor and ICT and IP Capital and Traditional Capital | Luiz Brotherhood; Universitat de Barcelona Vahagn Jerbashian; University of Barcelona |

| 7 | Bank Regulation and Sovereign Risk: A Paradox | António Afonso; ISEG University of Lisbon André Teixeira; ISEG University of Lisbon |

| 8 | Carbon Default Swap -- Disentangling the Exposure to Carbon Risk Through CDS | Alexander Blasberg; University of Duisburg-Essen Ruediger Kiesel; University Duisburg-Essen Luca Taschini; University of Edinburgh |

| 9 | Inflation Persistence, Noisy Information and the Phillips Curve | José-Elías Gallegos; Banco de España |

| 10 | GVCs Participation: A Stimulus for the New Goods Margins? | Onur Biyik; Waseda University Kunhyui Kim; Waseda University |

| 11 | Understanding the Gains from Wage Flexibility in a Currency Union: The Fiscal Policy Connection | Eiji Okano; Nagoya City University |

| 12 | International Reserve Accumulation: Balancing Private Inflows with Public Outflows | Bada Han; Bank of Korea |

| 13 | Competitive Attention, Entry and Market Concentration | Andreas Michael Hefti; University of Zurich |

| 14 | European Deep Integration and Productivity Heterogeneity | Adeel Dar; Martin Luther University Halle-Wittenberg |

| 15 | Economics of litigation: Securities class action with Third Party Litigation Funding | Sahil Chopra; Sorbanne University Paris Nord |

| 16 | Weather Shocks and Inflation Expectations in Semi-Structural Models | Jose Romero; Banco de la República Sara Naranjo; Banco de la República |

| 17 | Cognitive Ability, Education, and Fertility Risk | Diaz Diaz; Banco Central de Chile |

| 18 | The economy in people’s minds: are EU countries connected? | Pedro Cerqueira; University of Coimbra Rodrigo Martins; Universidade de Coimbra |

| 19 | Structural Reforms and Income Distribution: New Evidence for OECD Countries | Joao Jalles; University of Lisbon |

| 20 | Balance Sheet Expansionary Policies in the Euro Area: Macroeconomic Impacts and a Vulnerable versus Non-Vulnerable Comparison - A Bayesian Structural VAR Approach | Francisco Pereira; University of Lisbon - ISEG - REM |

| 21 | Do the projected fiscal deficits play a role in ECB monetary policymaking? | Francisco Pereira; University of Lisbon - ISEG - REM |

| 22 | Time-varying Granger Causality Tests of Covered and Uncovered Interest Rate Parity | IOANNIS KORKOS; London South Bank University Christina Anderl; London South Bank University |

| 23 | Measuring Uncertainty in Inflation Forecasting | Vanessa Espano; Bangko Sentral ng Pilipinas |

| 24 | The Impact of Short-term rentals of residential displacement | Maruska Vizek; Institute of Economics, Zagreb |

| 25 | Measuring Wealth: Income Capitalization with Heterogeneous Rates of Return | Alberto Vesperoni; King's College London Irem Bozbay; University of Surrey Roberto Iacono; Norwegian University of Science and Technology Elin Halvorsen; Statistics Norway |

| 26 | Real Exchange Rate and International Reserves in the Era of Financial Integration | Jamel Saadaoui; University of Strasbourg |

| 27 | The Carbon Footprint of Global Trade Imbalances | Hendrik Mahlkow; Kiel Institute for the World Economy (IfW) Joschka Wanner; University of Potsdam |

| 28 | The Effects of Foreign Investor Composition on Colombia’s Sovereign Debt Flows | Fredy Gamboa-Estrada; Banco de la Republica Andrés Sánchez Jabba; Banco de la República |

| 29 | Can Cash Transfers to the Unemployed Support Economic Activity? Evidence from South Africa | Timothy Kohler; University of Cape Town |

| 30 | The Evolution of Wages and Wage Inequality during the COVID-19 Pandemic in South Africa | Timothy Kohler; University of Cape Town |

| 31 | Trade Effects of Supply Chain Regulations: Empirical Evidence from the Loi de Vigilance | Galina Kolev-Schaefer; Cologne University of Applied Sciences / German Economic Institute |

| 32 | Deconstructing the Implications of Economic Sanctions on Mergers and Acquisitions' extensive margin | Federico Carril Caccia; University of Granada |

| 33 | ALTRUISM AROUND THE WORLD. WHAT CAN WE LEARN FROM INTERNATIONAL SURVEYS? | Jesús Artero; University of Seville Mª Ángeles Caraballo; University of Seville |

| 34 | Structural shocks and trend inflation | Ivan Mendieta-Munoz; University of Utah |

| 35 | Ad-valorem Taxes, Prices and Content Diversification in the News Market | Armando Jose Garcia Pires; Norwegian School of Economics (NHH) |

| 36 | A Review of the Behavioural Factors Influencing the Housing Market | Bachar Fakhry; NA |

| 37 | National Highways and International Goods | Sarur Chaudhary; University of Cambridge |

| 38 | Identifying the Main Drivers of Asylum Migration to OECD Countries. The Role of Political Push Factors and Recognition Rates | Felicitas Nowak-Lehmann; University of Goettingen |

| 39 | Adoption of sustainable practices in a cattle value chain in Colombia | Alexander Buriticá Casanova; Universidad de los Andes |

| 40 | Sectoral shocks, labor mobility and heterogeneity in price/wage stickiness | Ernil Sabaj; University of Warwick |

| 41 | Risk-sensitive Optimal Control with Forward-looking Variables | Guido Traficante; Università Europea di Roma and CASMEF Paolo Vitale; University G. d'Annunzio of Chieti-Pesca |

| 42 | Bank restructuring and regional economic growth in Spain. Are branches still relevant? | Paula Cruz-García; University of Valencia Jesús Peiró-Palomino; University of Valencia |

| 43 | Does the level of financial development matter for the fiscal response? A PSTR Approach for the EU and selected OECD Countries | Andrea Stoian; INFER |

| 44 | Income Inequality among Indians: a Cross-States and Cross-Community Analysis using India Human Development Survey Data | Madhurjya Bezbaruah; Gauhati University Mofidul Hassan; RANGIA COLLEGE |

| 46 | Robust Impulse Responses using External Instruments: the Role of Information | Davide Brignone; University of Rome Tor Vergata Alessandro Franconi; University of Modena and Reggio Emilia Marco Mazzali |

| 47 | Quantile Connectedness in Agri-commodity markets: What has changed over past six decades? | Bikramaditya Ghosh; Symbiosis Institute of Business Management,, Deemed University Dimitrios Paparas; Harper Adams University |

| 48 | Does competition contribute to stability? - empirical evidence from the European Union banking sector | CANDIDA FERREIRA; ISEG, Universidade de Lisboa |

| 49 | Fiscal Sustainability: The Case of Egypt | Ibrahim L. Awad Ibrahim; Qatar University |

| 50 | ESCAPING THE ENERGY POVERTY TRAP: POLICY ASSESMENT | Elisa Trujillo-Baute; University of Lleida |

| 51 | Adaptation to Flooding and its Effect on the Urban Form | Konrad Bierl; Humboldt Universität Berlin, Berlin School of Economics |

| 52 | Income elasticity for proteins, animal foods and animal proteins | Diana Kmetkova; Charles University in Prague Milan Scasny; Charles University in Prague |

| 53 | Digital Technology Adoption: Subsidizing Learning Costs for Firms in India | SANGHAMITRA MUKHERJEE; UNIVERSITY OF OXFORD |

| 54 | Spurious Precision in Meta-Analysis | Pedro R. D. Bom; Deusto Business School |

| 55 | The Global Financial Cycle and the Effects of Fed Unconventional Monetary Policies on Foreign Portfolio Flows in Colombia | David Castañeda; Santo Tomas University Fredy Gamboa-Estrada; Banco de la Republica |

| 56 | Green cultural transition, environmental taxes, and collective lobbying by social groups of citizens | Donatella Gatti; CEPN Université Sorbonne Paris Nord Julien Vauday; Université Sorbonne Paris Nord |

| 57 | On the relative contributions of national and regional institutions to economic development | Daniel Aparicio-Pérez; Universitat Jaume I |

| 58 | Comparing different features of a fiscal stimulus in the euro area | Jérôme Creel; ESCP Business School & Sciences Po - OFCE |

| 59 | An efficient Bayes classifier for word classification: an application on the EU Recovery and Resilience Plans | Michele Limosani; University of Messina Emanuele Millemaci; University of Messina Paolo Mustica; University of Messina |

| 60 | The impact of financial support for innovation on SMEs’ performance and efficiency | Raphaël Chiappini; University of Bordeaux Sophie Pommet; Université Côte d'Azur, GREDEG |

| 61 | The "Economic Value" of Law: Do Collective Action Clauses reduce sovereign bond restructuring costs? | Vitor Castro; Loughborough University Ricardo Sousa; University of Minho, NIPE and LSE Alumni |

| 62 | Sustainability, local environmental behaviour and firm location decisions | Josep-Maria Arauzo-Carod; Universitat Rovira i Virgili (ECO-SOS) & INFER |

| 63 | The (Non-)Neutrality of Value-Added Taxatio | Frank Stähler; University of Tübingen |

| 64 | Disentangling frictions across the world: markups versus trade costs | Benedikt Heid; Universitat Jaume I Frank Stähler; University of Tübingen |

| 65 | Exclusive and Non-Exclusive Licensing with Shelving | Sougata Poddar; Chapman University, Orange, California, USA |

| 66 | Trade Barriers and Sovereign Default Risk | George Alessandria; University of Rochester Yan Bai; University of Rochester Minjie Deng; Simon Fraser University Chang Liu; University of Rochester |

| 67 | Geographical mobility and educational mismatch in university graduates: timing, scope, and background | Nuria Legazpe; Universidad de Castilla - La Mancha Maria Davia; Universidad de Castilla la Mancha Cecilia Albert Verdú; Universidad de Alcalá |

| 68 | The impact of exchange rate fluctuations on earnings and labour supply of immigrants | Ronit Mukherji; University of British Columbia |

| 69 | Does heat cause homicides? A meta-analysis | Vojtěch Mišák; Charles University |

| 70 | Natural resources and China’s foreign assistance in Africa : a two-sided story | Koami TOGBETSE; University of Orleans |

| 71 | The negative impact of disintegration on trade: the case of Brexit | Asier Minondo; Deusto Business School |

| 72 | Corporate taxes and structural transformation: a micro-level analysis | Tommaso Bighelli; Halle Institute for Economic Research |

| 73 | Corporate Tax, R&D and Export Decisions: Evidence from European Firms | Ioannis Bournakis; SKEMA Business School Desiderio Romero-Jordán; Universidad Rey Juan Carlos (URJC) |

| 74 | Spousal relative income and spouses’ BMI: marriage selection and marriage market incentives | Joanna Syrda; University of Bath |

| 75 | Financial, Institutional, and Macroeconomic Determinants of Cross-Country Portfolio Equity Flows | António Afonso; ISEG - ULisbon |

| 76 | SHORT- AND LONG-TERM INTERDEPENDENCES BETWEEN SOCIAL EXPENDITURE, INEQUALITY AND GROWTH: A PANEL VECTOR ERROR CORRECTION APPROACH | Pedro Bação; University of Coimbra Joshua Duarte; Univ Coimbra, CeBER and Faculty of Economics Marta C. Simões; University of Coimbra |

| 77 | Expectation formation and the Phillips curve revisited | Robert Czudaj; Technical University of Freiberg |

| 78 | Trade Costs Geography and Evolution_Preliminary draft_ | Sebastian Villano; Universidad de la Republica - Uruguay |

| 79 | Scarring effects of major economic downturns: the role of fiscal policy and government investment | Peter Claeys; Universidad Pontificia Comillas |

| 80 | Religiosity, education and intra-household behavior: Evidence from East and West Germany | Valeria Córdova; KU Leuven Laurens Cherchye; University of Leuven Mariana Zerpa; KU Leuven |

| 81 | Use of Hired Labour in Small Farm Agriculture and Better Farming Practices: A Study in the Brahmaputra Valley of North East India | Anup Das; Rajiv Gandhi University |

| 82 | Misallocation of factors of production: evidence for Spanish manufacturing | Carolina Calatayud; University of Valencia Maria Engracia Rochina-Barrachina; University of Valencia and ERICES |

| 83 | Is Quantitative Easing Productive? The Role of Bank Lending in the Monetary Transmission Process | Philipp Roderweis; University Sorbonne Paris Nord Jamel Saadaoui; University of Strasbourg Francisco Serranito; Economix - CNRS UMR 7235 |

| 84 | Okun’s law in the V4 countries: its regional disaggregation and determinants | Jiří Škvor; Jan Evangelista Purkyně v Ústí nad Labem, Faculty of Natural Siences Martin Boďa; Matej Bel University in Banská Bystrica, Faculty of Economics Mariana Považanová |

| 85 | Determinants of the Duration of Economic Recoveries: The Role of 'Too Much Finance' | Boris Fisera; Faculty of Social Sciences, Charles University |

| 86 | Uncertainty is Bad for Business. Really? | Nicolas Himounet; Université Sorbonne Paris Nord Francisco Serranito; Economix - CNRS UMR 7235 Julien Vauday; Université Sorbonne Paris Nord |

| 87 | Energy Prices and Household Heterogeneity: Monetary Policy in a Gas-TANK | Jenny Chan; Bank of England Sebastian Diz; Central Bank of Paraguay Derrick Kanngiesser; Bank of England |

| 88 | Spain, Split and Talk: Quantifying Regional Independence | Hanna Adam; University of Bayreuth Mario Larch; University of Bayreuth Jordi Paniagua; University of Valencia |

| 90 | Job Search, Job Findings and the Role of Unemployment Insurance History | Similan Rujiwattanapong; Waseda University |

| 91 | Calibrating the EU’s difficult trade legacies | Prof. Dr. Agnieszka Gehringer; Technische Hochschule Köln |

| 92 | Multiple property ownership: the role of household characteristics and macroprudential policy | Andrej Cupák; National Bank of Slovakia Maria Siranova; Slovak Academy of Sciences |

| 94 | Borrowed Plumes: The Gender Gap in Claiming Credit for Teamwork | Jakob Moeller; WU Vienna University of Economics and Business Klara Kinnl |

| 95 | Platform market power and worker marginalization in online labor markets: Evidence from a fee change | Estrella Gomez-Herrera; University of Balearic Islands |

| 96 | Financial Inclusion, Mobile Money, and Regulatory Architecture | Martina Metzger; Berlin School of Economcis and Law |

| 97 | Overbuilding and Recession: A new Drawback of Housing Market Boom-and-Bust Cycle | Xiang SHI; HKUST |

| 98 | Foreign economic policy uncertainty shocks and real activity in the Euro area | Filippo Arigoni; Central Bank of Ireland |

| 99 | The economics of innate rewards | Lucie Letrouit; Gustave Eiffel University |

| 100 | The Indirect Effect of Import Competition on Corporate Tax Avoidance | Baptiste Souillard; Université Libre de Bruxelles |

| 102 | Market access, the skill premium and human capital in Spain (1860-1930) | Rafael González-Val; Universidad de Zaragoza & Institut d'Economia de Barcelona (IEB) Pau Insa-Sanchez; Università degli Studi di Siena Julio Martinez-Galarraga; Universitat de Barcelona Daniel Tirado; Universitat de Valencia |

| 103 | A single monetary policy for heterogeneous labour markets: the case of the euro area | sandra gomes; Banco de Portugal Pascal Jacquinot; ECB Matija Lozej; Central Bank of Ireland |

| 104 | Endogenous Growth Model for Resource Economy | Yuri Yegorov; Economica |

| 105 | Mind the gap: patent citation by gender when sexes differ in labour mobility patterns | Carlos Llano; Universidad Autónoma de Madrid Julián Moral; Universidad Autónoma de Madrid Santiago Pérez; UAM |

| 106 | Employment effects from digitalisation: Evidence from Spanish manufacturing firms | Dolores Añon Higon; Universitat de Valencia Daniel Bonvin; Universitat de València |

| 107 | Monetary policy shocks and precautionary cash in Europe | Benedicta Marzinotto; University of Udine, Economics Department |

| 108 | Municipalities attractiveness and the pandemic. An analysis for the Spanish population flows | Celia Melguizo; University of Valencia Juan Sanchis- Llopis; University of Valencia |

| 109 | Inequality and climate change: the within-countries distributional effects of global warming | David Castells-Quintana; Universidad Autonoma de Barcelona |

| 110 | The impact of technology and connectivity on trade patterns | Isabelle Rabaud; Laboratoire d'Economie d'Orléans Camelia Turcu; University of Orléans - LEO Marcel-Cristian Voia; Economics |

| 111 | Macroeconomic News and Sovereign Interest Rate Spreads before and during Quantitative Easing | Karsten Staehr; Tallinn University of Technology |

| 112 | The impact of the shifts in tourism accommodation composition on housing prices: The case of Croatia | Tajana Barbic; Ekonomski institut, Zagreb |

| 113 | Optimal macroeconomic policies for nonlinear econometric models with rational expectations | Dmitri Blueschke; Alpen-Adria-Universität Klagenfurt Viktoria Blueschke-Nikolaeva; Alpen-Adria-Universität Klagenfurt Reinhard Neck; Alpen-Adria-Universität Klagenfurt |

| 114 | The Gendered Impact of In-State Tuition Policies on Undocumented Immigrants’ College Enrollment, Graduation, and Employment | Eva Dziadula; University of Notre Dame |

| 115 | What determines demand for digital community currencies? OurVillage in Cameroon | Jennifer Pédussel Wu; Berlin School of Economics and Law |

| 116 | Did Unilateral Divorce raise house prices in Europe? | Rafael González-Val; Universidad de Zaragoza & Institut d'Economia de Barcelona (IEB) Miriam Marcén; Universidad de Zaragoza |

| 117 | The spatial interaction between FDI and female entrepreneurship | Alicia Gómez-Tello; Universitat de València Rosella Nicolini; Universitat Autònoma de Barcelona |

| 118 | Decomposing the (In)Sensitivity of CPI to Exchange Rates | Marco Errico; Boston College - Bank of Italy |

| 119 | Agglomeration and Human capital: An extension of the Spatial Mankiw-Romer-Weil model for the European regions | Alicia Gómez-Tello; Universitat de València Maria-Jose Murgui-Garcia; University of Valencia Teresa Sanchis-Llopis; Universitat de València |

| 120 | Careers in Multinational Enterprises | Michiel Gerritse; Erasmus University Rotterdam Bas Karreman; Erasmus School of Economics Marcus Roesch; Erasmus University Rotterdam |

| 121 | Accounting for Cross-Country Output Differences: A Sectoral CES Perspective | Jan Trenczek; University of Mainz Konstantin Wacker; University of Groningen |

| 122 | “Brown” Risk or “Green” Opportunity? The pricing of climate transition risk on global financial markets | Philip Fliegel; Humboldt University Berlin |

| 123 | Granular Firms and Aggregate Fluctuations | Omar Blanco-Arroyo; Universitat Jaume I |

| 124 | Aid, Trade, and Modern Slavery | Bianca Willert; Friedrich-Alexander University Erlangen-Nuremberg |

| 125 | Minimum Wage, Workforce Composition, and Robot Adoption | Verena Plümpe; Halle Institute for Economic Research |

| 126 | Statistical Discrimination in Court Decisions: A model on crime choice, group characteristics, and conviction probabilities | Bianca Willert; Friedrich-Alexander University Erlangen-Nuremberg |

| 127 | Sectoral Exposure to Aggregate Fluctuations, Employment Risk and Monetary Policy | Uros Herman; GSEFM, Goethe University Frankfurt |

| 128 | Private Supplementary Education and the Welfare Loss of Price Controls in Higher Education | Willem De Cort; KU Leuven |

| 129 | Minimum Social Security Benefit(s) and the Alone Stage of Retirement in the US | Lori Curtis; University of Waterloo |

| 130 | In Defence of the Endogenous Growth Theory: 'Conditional' and 'Unconditional' Convergence in Two-Country AK Models | Carmelo Parello; Sapienza Università di Roma |

| 131 | Conceptional Issues of Community Currencies | Martina Metzger; Berlin School of Economcis and Law |

| 132 | Social expenditure composition, welfare models and standards of living across the OECD | Marcelo Santos; Univ Coimbra, CeBER, Faculty of Economics Marta C. Simões; University of Coimbra |

| 133 | Accounting for currency crises: what matters are external deficits, not loose money or speculative attacks | Nikolas Müller-Plantenberg; Universidad Autónoma de Madrid |

| 135 | Power and Port Dependence: Estimating the Effect of China’s Belt and Road Initiative on Maritime Trade | Clark Banach; Freie Universität Berlin Jennifer Pédussel Wu; Berlin School of Economics and Law |

| 136 | Does the community currency lead to sustaining progress in achieving the SDGs? The Kenyan case study | arafet Farroukh; FSEGT and LIEI university Tunis EL Manar |

| 137 | Disclosing the sub-national tradability of services in Europe | Carlos Llano-Verduras; UAM |

| 138 | Tracking trucks: modelling the interregional granular Spanish flows with France and Portugal | Nuria Gallego; Universidad Rey Juan Carlos Carlos Llano-Verduras; UAM Santiago Pérez-Balsalobre; Universidad Autónoma de Madrid |

| 139 | Remittances and domestic private investment in sub-saharan african countries: how local financial development matter? | Askandarou Cheik DIALLO; LEO |

| 140 | Structural Change at a Disaggregated Level: Sectoral Heterogeneity Matters | Ali Sen; University of Cambridge |

| 141 | Everybody's got to learn sometime ? A causal machine learning evaluation of training program for jobseekers in the Grand Est region of France. | Héloïse Burlat; University of Strasbourg (BETA) |

| 142 | India in the Global Market for ICT Goods: Possibilities from Integration with the United States | UTTAM KARMAKAR; GAUHATI UNIVERSITY AMIYA SARMA; GAUHATI UNIVERSITY |

| 143 | Left behind in COVID times: The impact of the pandemic on job loss and job finding rates of vulnerable groups in Serbia | Marko Vladisavljevic; Institute of Economic Sciences, Belgrade, Serbia Lara Lebedinski; Institute of Economic Sciences |

| 145 | Coordination of complementary tourism supply: the pursuit of profitability in the presence of a foreign tour operator | Carmen D. Álvarez-Albelo; Universidad de La Laguna José Alberto Martínez-González; Universidad de La Laguna |

| 146 | Working Capital Management, Financial Constraints, and Exports: Evidence from European small and medium firms | Jose Manuel Mansilla-Fernandez; Public University of Navarre Juliette MILGRAM; private |

| 147 | Determinants of the degree of fiscal sustainability | António Afonso; ISEG - ULisbon José Alves; REM - Research in Economics and Management José Coelho; ISEG - Lisbon School of Economics a |

| 148 | Total factor productivity and firm size in the German energy industry: Evidence from a symbolic transfer entropy panel causality test | Claudiu Albulescu; Politehnica Timisoara ahdi noomen ajmi; ESC de Tunis Serban Miclea; Politehnica University of Timisoara Lavinia Mihali; Politehnica University of Timisoara |

| 149 | Premature mortality and sustainability from a the gender perspective | Ana Ledesma; Facultad de Economía y Empresa, Universidad de Zaragoza Antonio Montanes; University of Zaragoza Blanca Simón; Universidad de Zaragoza |

| 150 | Globalization and the Phillips curve: A G7 comparative study | Gilles Dufrénot; Aix-Marseille School of Economics Lucie Giorgi; Aix-Marseille School of Economics |

| 151 | Over/Under-reaction and Judgment Noise in Expectations Formation | Junyi Liao; London School of Economics |

| 152 | Current account determinants in a globalized world | Mariam Camarero; Universitat Jaume I Josep Lluís Carrion-i-Silvestre; University of Barcelona Cecilio Tamarit; University of Valencia |

| 153 | Orbital debris and the market for satellites | José Torres; UNIVERSIDAD DE MÁLAGA |

| 154 | Information asymmetries and firm investment choices: Evidence from the ECB's Corporate QE | Supriya Kapoor; Trinity College Dublin |

| 155 | DOES ORGANISATIONAL INNOVATION MATTER FOR ENVIRONMENTAL R&D? | Pablo del Río; Consejo Superior de Investigaciones Científicas Jose García-Quevedo; University of Barcelona, IEB Ester Martinez-Ros; Universidad Carlos III de Madrid |

| 156 | LINGUISTIC IMMERSION AND LABOUR MARKET PERFORMANCE OF MIGRANTS | Joan Martín-Montaner; Universitat Jaume I Francisco Requena; University of Valencia Guadalupe Serrano; University of Valencia |

| 157 | Testing for the cointegration rank between periodically integrated processes | Tomás del Barrio Castro; University of the Balearic Islands |

| 158 | Does Green Transition promote Green Innovation and Technological Acquisitions? | Udichibarna Bose; University of Essex Wildmer Daniel Gregori; Banco de Portugal Maria Martinez Cillero; Joint Research Centre, European Commission |

| 159 | Firm dynamics, informality, and monetary policy | Carlos Yepez; University of Manitoba |

| 160 | Building on scal policy: government consumption and the residential sector. When helping hurts | Javier Ferri; University of Valencia Francisca Herranz; Universitat de Valencia |

| 161 | Disinflation Costs and Macroprudential Policies: Real and Welfare Effects | Monica Varlese; University of Naples Federico II |

| 162 | Inflation-based fiscal consolidation: a DSGE approach | Monica Varlese; University of Naples Federico II |

| 163 | Full-scale Russia's trade sanctions and their welfare outcomes | Evgenii Monastyrenko; University of Luxembourg Pierre Picard; University of Luxembourg |

| 164 | The stabilization role of CAP direct payments: Some shocking aspects | Cécile COUHARDE |

| 165 | Firm risk shocks and the banking accelerator | Tommaso Gasparini; University of Mannheim Vivien Lewis; Deutsche Bundesbank Stephane Moyen; Deutsche Bundesbank Stefania Villa; Bank of Italy |

| 166 | Debt Relief : The Day After, Financing Low-Income Countries | Gregory Donnat; Cote d'Azur University Anna TYKHONENKO; University Côte d'Azur |

| 168 | Firms Heterogeneity and Intra-Industry Reallocation: Beyond Dichotomous Partitioning | Xi Chen; ANEC/STATEC |

| 169 | Unpacking the green box: Determinants of Environmental Policy Stringency in European countries | Donatella Gatti; CEPN, University Paris 13 Gaye-Del Lo; CEPN UMR CNRS 7234 Francisco Serranito; Economix - CNRS UMR 7235 |

| 170 | EU populism and online social media horizons | Cristina Strango |

| 171 | Green Stimulus vs. Traditional Fiscal Stimulus: A Comparative Analysis of Welfare and Output Multipliers | Juha Tervala; University of Helsinki Timothy Watson; Australian National University |

| 172 | How Social Movements Affect Educational Outcomes: Theory and BLM Evidence | Nagham Sayour |

| 173 | The cumulative causation process between Foreign Direct Investment, Entrepreneurship and Wealth in Portugal. The dark side of the virtuous circle. | Elias Soukiazis; FEUC |

| 174 | How does R&D outsourcing affects firm's total R&D? Theory and Evidence | Adriana Brenis; University of Sheffield Antonio Navas; University of Sheffield Peter Wright; University of Sheffield |

| 175 | Change in leadership on the international soybean market: A time-varying investigation | Gustavo Barboza; Harper-Adams University |

| 177 | A time-varying estimation of an external reaction function for EMU countries: the role of risk-aversion and financial openness | Mariam Camarero; Universitat Jaume I Juan Sapena; Catholic University of Valencia Cecilio Tamarit; University of Valecia |

| 178 | Forced migration and food crises: a coming catastrophe? | Federico Carril Caccia; University of Granada Jordi Paniagua; University of Valencia Marta Suárez-Varela Maciá; Bank of Spain |

| 179 | Carbon pricing and inflation volatility | Daniel Santabarbara; Bank of Spain Marta Suárez-Varela Maciá; Bank of Spain |

| 180 | Unilateral and bilateral risk sharing impacts of Banking Union in the European Union: do individual or common correlated effects matter? | Leonore Raguideau-Hannotin; French Treasury and CRIEF, Poitiers University, France |

| 181 | Unconventional monetary policy and ECB communication: between confusion and predictability | Cornel OROS; CRIEF, University of Poitiers Marc Pourroy; University Poitiers Leonore Raguideau-Hannotin; French Treasury and CRIEF, Poitiers University, France Anne-Gaël Vaubourg; Université de Poitiers |

| 182 | Monetary policy and exchange rate regimes under dominant currency paradigm | Florina-Cristina Badarau; University of Bordeaux, INFER |

| 183 | Marriage Effect, Education, and Gender Differences | Liyuan Dong; National University of Singapore Jie Ren; Central University of Finance and Economics |

| 185 | Evaluating the Load Capacity Factor for EU Countries: Linking Environmental Quality to Economic Growth, Energy Use, Population Density, and Energy Intensity | Ioannis Kostakis; Harokopio University of Athens Dimitrios Paparas; Harper Adams University |

| 186 | Educational Mismatch and Labour Market Institutions: The Role of Gender | Theresa Geissler; IAAEU and Trier University Laszlo Goerke; IAAEU -Trier University |

| 187 | Cost sharing mechanisms for carbon pricing: What drives support in the building sector? | Christian Oberst; German Economic Institute (IW) |

| 188 | Inflation Vs traditional deflator instruments: a comparison between debt management strategies in USA, EU and China | Claudia Ulloa Severino; Università degli studi di Napoli "Parthenope" |

| 191 | Facility Management Services in UK Hospitals: In-House or Outsourcing | Pierre Picard; University of Luxembourg Alena Podaneva; University of Luxembourg |

| 192 | Minimum Wage and Multinational Activity | Bin Ni; Hosei University |

| 193 | The Role of Global Factors in the Post-Pandemic Inflation in Europe: Do Global Supply Chains Matter? | Gyowon Gwon; CEPN, University Sorbonne Paris Nord Serhan Cevik; International Monetary Fund |

| 194 | Do immigration and social networks boost trade? Evidence of EU-MENA Region | Fatima El Khatabi; Universidad Autónoma de Madrid and University of Goettingen Inmaculada Martínez-Zarzoso; Universitat Jaume I |

| 195 | Sustainable development and the extractive industry. An assessment of the Mexican case | Camelia Turcu; University of Orléans - LEO |

| 196 | Do bankers want their umbrellas back when it rains? Evidence from typhoons in China | Camelia Turcu; University of Orléans - LEO |

| 197 | Natural resources, Energy transition and Chinese FDI in Africa | Camelia Turcu; University of Orléans - LEO |

| 199 | Export diversification, inequality, and energy transition in resource-rich countries: a panel quantile regression approach | Camelia Turcu; University of Orléans - LEO |

| 200 | Extreme Weather Events and Debt: the Case of Asian and African Regions | Camelia Turcu; University of Orléans - LEO |

| 201 | Do firms react to supply-chain disruptions? | Juan de Lucio; Universidad de Alcalá de Henares Carmen Díaz-Mora; University of Castilla-La Mancha Raúl Mínguez Asier Minondo; Deusto Business School Francisco Requena; University of Valencia |

| 202 | Revisiting the Link between Inequality and Carbon Dioxide Emissions | Inmaculada Martinez-Zarzoso; Universitat Jaume I Francisco Requena; University of Valencia |

| 203 | Too little good finance? Financial asymmetries, risk sharing and growth in the EU | Eleonora Cavallaro; University of Rome Sapienza ILARIA VILLANI; European Central Bank |

| 204 | The link between economic growth and ecological footprint – Evidence for European Countries | Christian Oberst; German Economic Institute (IW) |

| 206 | The Policy Effects of Deregulating Capacity Expansion of High-performing Charter Schools | Faqiang Li; Pennsylvania State University Francisco Requena; University of Valencia |

| 207 | The role of renewable energies in decoupling ecological footprint and economic growth. Is the relationship stable over time? | Bárbara Baigorri García; Univesidad Zaragoza Antonio Montanes; University of Zaragoza Blanca Simón; Universidad de Zaragoza |

| 208 | Measuring financial inclusion on time: A multivariate index for Mexican municipalities 2013-2021 | Paula Cruz-García; University of Valencia María del Carmen Dircio Palacios Macedo; Universitat Jaume I Francisco Requena; University of Valencia Emili Tortosa |

| 209 | The rise and decline of industrial dynamics in Portugal during 1986-2018 | Carlos Carreira; University of Coimbra Ernesto Nieto-Carrillo; University of Coimbra Francisco Requena; University of Valencia Paulino Teixeira; University of Coimbra |

| 210 | Non-tariff Measures on the Production Network: Analysis on the Forward and Backward Participation in Global Value Chain | Kunhyui Kim; Nagoya University Francisco Requena; University of Valencia |

| 211 | Where You Lead I Will Follow: Heterogeneity in Migration Network Effects Across Cultures | Tamara Bogatzki; Berlin Social Science Center (WZB) Francisco Requena; University of Valencia |

| 212 | Multinational Production, Trade, and Carbon Emissions | Francisco Requena; University of Valencia Joschka Wanner; University of Potsdam Yuta Watabe; Xiamen University |

| 213 | Spill-over effects of Minimum Wages on the Informal Sector: Evidence from Vietnam | Trang Tran; CERGE EI |

| 214 | Microfinance as a Financial Inclusion Strategy: an Empirical Assessment in Developing Countries | Reda Marakbi; LEM - University of Artois |

| 215 | A fresh assessment of the euro effect on outward US FDI | Mariam Camarero; Universitat Jaume I Cecilio Tamarit; University of Valencia |

| 216 | Benefitting from GVC participation: the role of network centrality | Marta Solaz; Universitat de València Mariola Sanchez; University of Valencia |

| 217 | ENVIRONMENTAL STRINGENCY AND INTERNATIONAL TRADE – A LOOK ACROSS THE GLOBE | Inmaculada Martinez-Zarzoso; Universitat Jaume I |

| 218 | ENERGY POVERTY IN THE EU-28 AND DISPARITIES IN POLICIES TO COMBAT IT | José C. de los Riscos; University of Castilla-La Mancha Leticia Blázquez; University of Castilla-La Mancha Juan A. García; University of Castilla-La Mancha |

| 219 | BUSINESS CYCLE AND FIRM EXPORT/IMPORT DYNAMICS | Silviano Esteve, UV, Salvador Gil-Pareja, UV |

| 220 | The Impact of Trade Liberalization on the Energy Intensity of Indian Firms | Inma Martínez-Zarzoso Shampa Roy-Mukherjee Finn-Ole Semrau Anca M. Voicu |

Registration must be done on the INFER website.

The deadline for registration is: June 15th, 2023

IMPORTANT DATES

March, 15th 2023 – Extended Deadline for submission of full papers

April 30th , 2023 – Deadline for notification of paper acceptance

June 15th, 2023 – Deadline for fee payment and registration

SUBMISSION OF PAPERS

Only full papers may be submitted for the INFER Annual Conference (this applies to both general sessions and special sessions). Papers must be in English and must include a cover page with the following information:

- An abstract of up to 500 words, with JEL classification and no more than 5 keywords

- Authors’ full name and affiliation

- Contact details for the corresponding author, such as address, phone and e-mail

Papers should be submitted electronically as pdf-files to the Annual Conference organizers via Conference Maker at the following website (submission open on December 1st, 2022): https://Joint 25INFER-XXINTECO Conference

Authors are allowed to submit more than one paper. All submitted papers will be peer reviewed according to a high-quality and fast referee process. Paper presenters are expected to discuss one other paper during the conference. The discussant assignments will be made by the conference organizers at a later stage. As the conference intends to strengthen the INFER network, participation is welcome even without paper contribution.

PUBLICATION OPPORTUNITIES

The conference offers publication opportunities to the authors of research papers. In particular, the authors of high-quality research papers will be invited to submit them to the following special issues:

Macroeconomic Dynamics. Cambridge University Press.

The procedure for submitting the papers to these journals will be specified in due course.

You will be informed more specifically about all publication possibilities during the next months.

The last INFER publications include special issues in the World Economics, Journal of International Money and Finance, International Economics, Economic Modelling, Comparative Economic Studies, Eastern European Economics, Post-Communist Economies, Research in International Business and Finance, International Economics and Economic Policy, Macroeconomic Dynamics. You will be informed more specifically about all publication possibilities during the next months.

SPECIAL SESSIONS

The conference will host a number of special sessions focusing on specific topics.

• These sessions may be organized by INFER scholars as well as by other conference attendees who send their proposals to the Organizing Committee.

• Special sessions will have discussants distributed among presenters of the same session.

• The deadline for the proposal of Special Sessions is January 15th, 2023. You can drop a line with your proposal to the following address: inteco@uji.es

The conference is jointly organized by INFER (International Network for Economic Research), and INTECO (Joint Research Unit on Economic Integration of the University of Valencia and Jaume I).

INFER (International Network for Economic Research) is a non-profit international scientific organization that stimulates research and research networking in all fields of economics through international workshops and conferences.

Website: http://www.infer-research.eu/

INTECO (Research Joint Unit on Economic Integration) from the University of Valencia and Jaume I (Castellón), Spain. Founded in 2001, INTECO aims to develop a research program on economic effects of real and financial integration.

Website: https://www.inteco.uji.es

SCIENTIFIC COMMITTEE

- Chair: Francisco REQUENA SILVENTE (INTECO-University of Valencia)

- António AFONSO (INFER, Universty of Lisbon)

- Adriana ALBENTOSA (University of Valencia)

- Josep-Maria ARAUZO-CAROD (INFER, University Rovira i Virgili)

- DimitriOs ASTERIOU

- Christian OBERST (INFER, German Economic Institute – IW Cologne)

- Claudiu ALBULESCU (INFER, Politehnica University of Timisoara)

- Amélie BARBIER-GAUCHARD (BETA, Strasbourg University)

- Florina-Cristina BADARAU (INFER, University of Bordeaux)

- María CABALLER (University of Valencia)

- Mariam CAMARERO (INFER, University Jaume I)

- Pedro CANTOS (University of Valencia)

- Eleonora CAVALLARO (INFER, Sapienza University of Rome)

- Laura MÁRQUEZ-RAMOS (INTECO-University Jaume I)

- Helena LENIHAN (INFER, University of Limerick)

- Antonia LÓPEZ-VILLAVICENCIO (University of Paris-Nanterre)

- Inmaculada MARTÍNEZ-ZARZOSO (INFER, INTECO-University of Goettingen)

- Guillermo MATEU (University of Valencia).

- Alexandru MINEA (INFER, University fo Auvergne)

- Christian OBERST (INFER, German Economic Institute – IW Cologne)

- Dimitrios PAPARAS (INFER, Harper Adams University)

- María Asunción PRATS ALBENTOSA (Universidad of Murcia)

- Francisco SERRANITO (INFER, University of Nanterre)

- Jamel SAADAOUI (BETA, Strasbourg University)

- Juan SAPENA BOLUFER (Catholic University of Valencia)

- Emili TORTOSA-AUSINA (INTECO, University Jaume I)

- Camelia TURCU (INFER, University of Orléans)

LOCAL ORGANIZING COMMITTEE

- Chair: Cecilio TAMARIT (INFER, INTECO-University of Valencia)

- Josep-Maria ARAUZO-CAROD (INFER, University Rovira i Virgili)

- Christian OBERST (INFER, German Economic Institute – IW Cologne)

- Claudiu ALBULESCU (INFER, Politehnica University of Timisoara)

- Francisco REQUENA SILVENTE (INTECO-University of Valencia)

- Mariam CAMARERO (INTECO-University Jaume I)

- Guadalupe SERRANO DOMINGO (INTECO-University of Valencia)

- Alejandra MARTÍNEZ MARTÍNEZ (INTECO-University of Valencia)

- Carolina CALATAYUD GALIANA (University of Valencia)

- Mercedes BELTRÁN ESTEVE (University of Valencia)

- Celia MELGUIZO CHÁFER (University of Valencia)

- Sergi MOLINER CLEMENTE (INTECO, University Jaume I)

- Daniel APARICIO PÉREZ (University Jaume I)